|

by Himanshy Damle

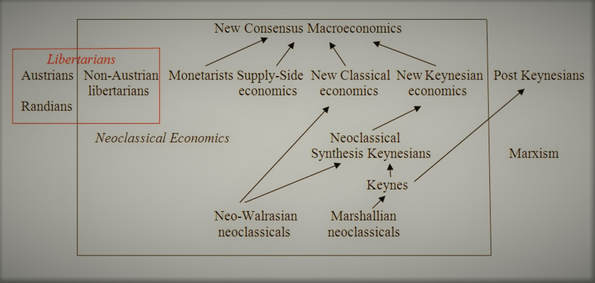

During the very years when orthodoxy turned Keynesianism on its head, extolling Reaganomics and Thatcherism as adequate for achieving stabilisation in the epoch of global capitalism, Minsky (Stabilizing an Unstable Economy) pointed to the destabilising consequences of this approach. The view that instability is the result of the internal processes of a capitalist economy, he wrote, stands in sharp contrast to neoclassical theory, whether Keynesian or monetarist, which holds that instability is due to events that are outside the working of the economy. The neoclassical synthesis and the Keynes theories are different because the focus of the neoclassical synthesis is on how a decentralized market economy achieves coherence and coordination in production and distribution, whereas the focus of the Keynes theory is upon the capital development of an economy. The neoclassical synthesis emphasizes equilibrium and equilibrating tendencies, whereas Keynes‘s theory revolves around bankers and businessmen making deals on Wall Street. The neoclassical synthesis ignores the capitalist nature of the economy, a fact that the Keynes theory is always aware of.

Minsky here identifies the main flaw of the neoclassical synthesis, which is that it ignores the capitalist nature of the economy, while authentic Keynesianism proceeds from precisely this nature. Minsky lays bare the preconceived approach of orthodoxy, which has mainstream economics concentrating all its focus on an equilibrium which is called upon to confirm the orthodox belief in the stability of capitalism. At the same time, orthodoxy fails to devote sufficient attention to the speculation in the area of finance and banking that is the precise cause of the instability of the capitalist economy.

Elsewhere, Minsky stresses still more firmly that from the theory of Keynes, the neoclassical standard included in its arsenal only those earlier-mentioned elements which could be interpreted as confirming its preconceived position that capitalism was so perfect that it could not have innate flaws. In this connection Minsky writes:

Whereas Keynes in The General Theory proposed that economists look at the economy in quite a different way from the way they had, only those parts of The General Theory that could be readily integrated into the old way of looking at things survive in today‘s standard theory. What was lost was a view of an economy always in transit because it accumulates in response to disequilibrating forces that are internal to the economy. As a result of the way accumulation takes place in a capitalist economy, Keynes‘s theory showed that success in operating the economy can only be transitory; instability is an inherent and inescapable flaw of capitalism.

The view that survived is that a number of special things went wrong, which led the economy into the Great Depression. In this view, apt policy can assure that cannot happen again. The standard theory of the 1950s and 1960s seemed to assert that if policy were apt, then full employment at stable prices could be attained and sustained. The existence of internally disruptive forces was ignored; the neoclassical synthesis became the economics of capitalism without capitalists, capital assets, and financial markets. As a result, very little of Keynes has survived today in standard economics.

Here, resting on Keynes‘s analysis, one can find the central idea of Minsky‘s book: the innate instability of capitalism, which in time will lead the system to a new Great Depression. This forecast has now been brilliantly confirmed, but previously there were few who accepted it. Economic science was orchestrated by proponents of neoclassical orthodoxy under the direction of Nobel prizewinners, authors of popular economics textbooks, and other authorities recognized by the mainstream. These people argued that the main problems which capitalism had encountered in earlier times had already been overcome, and that before it lay a direct, sunny road to an even better future.

Robed in complex theoretical constructs, and underpinned by an abundance of mathematical formulae, these ideas of a cloudless future for capitalism interpreted the economic situation, it then seemed, in thoroughly convincing fashion. These analyses were balm for the souls of the people who had come to believe that capitalism had attained perfection. In this respect, capitalism has come to bear an uncanny resemblance to communism. There is, however, something beyond the preconceptions and prejudices innate to people in all social systems, and that is the reality of historical and economic development. This provides a filter for our ideas, and over time makes it easier to separate truth from error. The present financial and economic crisis is an example of such reality. While the mainstream was still euphoric about the future of capitalism, the post-Keynesians saw the approaching outlines of a new Great Depression. The fate of Post Keynesianism will depend very heavily on the future development of the world capitalist economy. If the business cycle has indeed been abolished (this time), so that stable, non-inflationary growth continues indefinitely under something approximating to the present neoclassical (or pseudo-monetarist) policy consensus, then there is unlikely to be a significant market for Post Keynesian ideas. Things would be very different in the event of a new Great Depression, to think one last time in terms of extreme possibilities. If it happened again, to quote Hyman Minsky, the appeal of both a radical interventionist programme and the analysis from which it was derived would be very greatly enhanced.

Neoclassical orthodoxy, that is, today‘s mainstream economic thinking proceeds from the position that capitalism is so good and perfect that an alternative to it does not and cannot exist. Post-Keynesianism takes a different standpoint. Unlike Marxism it is not so revolutionary a theory as to call for a complete rejection of capitalism. At the same time, it does not consider capitalism so perfect that there is nothing in it that needs to be changed. To the contrary, Post-Keynesianism maintains that capitalism has definite flaws, and requires changes of such scope as to allow alternative ways of running the economy to be fully effective. To the prejudices of the mainstream, post-Keynesianism counterposes an approach based on an objective analysis of the real situation. Its economic and philosophical approach – the methodology of critical realism – has been developed accordingly, the methodological import of which helps post-Keynesianism answer a broad range of questions, providing an alternative both to market fundamentalism, and to bureaucratic centralism within a planned economy. This is the source of its attraction for us….

The article is taken from:

0 Comments

Leave a Reply. |

Steven Craig Hickman - The Intelligence of Capital: The Collapse of Politics in Contemporary Society

Steven Craig Hickman - Hyperstition: Technorevisionism – Influencing, Modifying and Updating Reality

Archives

April 2020

|

RSS Feed

RSS Feed